Indiana Foster Care Donation Tax Credit

Double Your Impact for Children and Families

Your gift can go twice as far to help Indiana’s children in foster care!

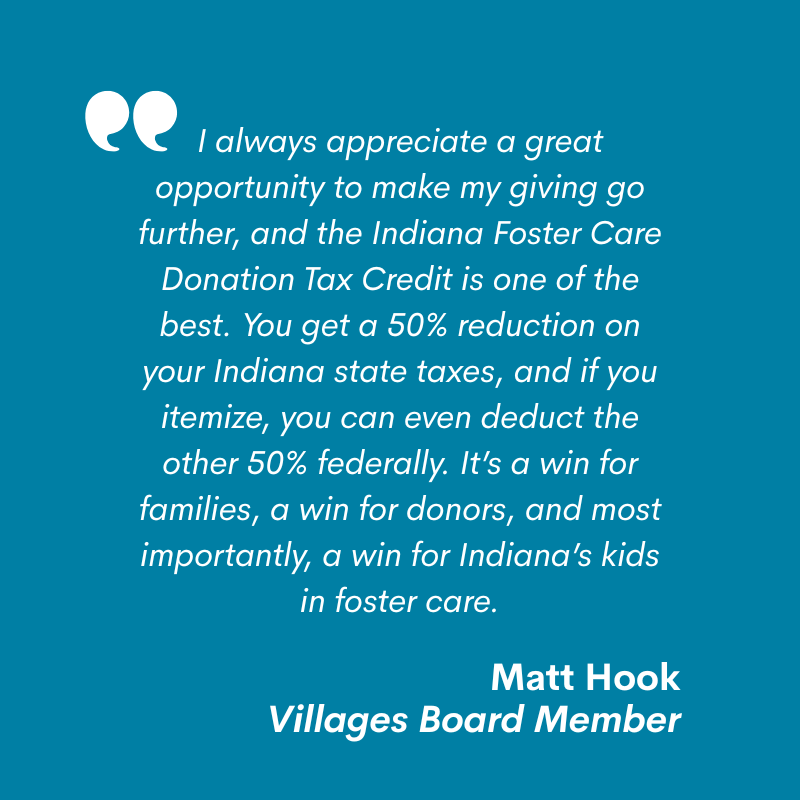

Through the Indiana Foster Care Donation Tax Credit, individuals and businesses with Indiana state tax liability can receive a 50% tax credit – up to $10,000 per year – for approved donations made to The Villages of Indiana.

That means a $20,000 gift could provide $10,000 in direct tax savings, while helping children and families thrive.

DOR: Foster Care Donation Tax Credit – Includes up-to-date information on remaining credits.

Application for Foster Care Donation Tax Credit

DONATE NOW

You may be eligible if you:

-

Pay Indiana state taxes as an individual or corporation

-

Make a monetary donation to The Villages of Indiana

-

Claim the credit in the same tax year your donation was made

-

Make your gift online or mail a check to:

The Villages of Indiana

3833 N. Meridian Street

Indianapolis, IN 46208 -

Receive your acknowledgment.

-

Online donors receive an instant email receipt.

-

Mail or in-office donors will receive an acknowledgment letter within 5–7 business days.

-

-

Submit your application and proof of donation to the Indiana Department of Revenue (DOR) by mail or fax (see instructions on the application).

-

Watch for DOR approval.

-

Within 45 days, you’ll receive an approval or denial letter.

-

Approved donors receive a certification number to use when filing their Indiana tax return.

-

-

Tax credits are awarded on a first-come, first-served basis.

-

Once the state’s available credits are used for the year, remaining applications cannot be approved.

The Villages is happy to assist donors through each step of the process. Please contact Peter Erotas, Director of Development, at PErotas@villages.org.